Carbon Pricing

EcoAct’s Carbon and Energy Pricing Tool can support you through analysis of regulatory risks and implementation of a tailored carbon pricing mechanism. We know the demands of business are many. We can help reduce the burden of this one.

For over 18 years, we've offered climate, biodiversity, and sustainability consulting to aid businesses in addressing environmental challenges and enhancing their commercial success.

climate risks and opportunities assessments

climate and sustainability projects since 2015

climate and biodiversity experts around the globe

Carbon pricing mechanisms are key climate policy tools to help push companies towards a low-carbon future. Carbon pricing is designed to ensure that businesses pay for the social and environmental costs of their carbon emissions. By raising the cost of carbon-intensive activities, carbon pricing mechanisms (carbon taxes and carbon markets) push companies to decarbonise and adopt more climate-friendly processes.

Governments require firms in certain industries to pay for their carbon emissions. Usually implemented via a carbon tax or cap-and-trade system. The EcoAct Carbon and Energy Pricing Tool calculates corporate financial risk, based on an up-to-date index of all national regulatory carbon prices.

Carbon and energy prices have undergone notable increases in recent years, posing significant financial risks for sectors reliant on fossil fuels. Recent research by EcoAct estimates that carbon price costs could account for 10% of the revenue of carbon-intensive sectors by 2030.

Companies voluntarily apply a price to carbon emissions within their operations and/or supply chain to drive their decarbonisation efforts.

Integrating the carbon indicator into financial decisions by adopting internal carbon pricing mechanisms allows companies to inform and drive their transformation. By monetising the carbon impact of decisions in the short and long term, internal carbon pricing mechanisms help to assess the financial risks associated with the organisation’s business model and mitigate them by redirecting financial flows towards assets compatible with a low-carbon economy.

Whether your goal is to align your investments with your emission reduction strategy, raise awareness among your employees about the climate impacts of their operational decisions, finance your decarbonisation projects, or reduce the carbon footprint of your supply chain, we can support you in implementing an internal carbon pricing mechanism tailored to your needs.

[1] It should be noted that the energy price scenarios are sourced from the EnerFuture database and are provided by the data provider Enerdata (Source: Enerdata/EnerFuture http://www.enerdata.net). End-user energy prices consider industry demand, production costs, national taxes and subsidies, as well as the latest geopolitical and climate policy developments.

The mechanisms for carbon pricing are an essential tool for directing behaviours towards a low-carbon transition. Internally, carbon pricing aims to direct flows of funds towards climate-compatible initiatives and helps to fund your organisation’s transition.

As we move towards a net-zero world, ensuring that energy efficiency and robust energy management is embedded throughout the business is more important than ever. Achieve energy savings through robust data collection, specialist systems and detailed analysis.

Mehr lesen for Energy Management SystemsEnsuring transparency and driving commercial benefits in your renewable energy sourcing.

Mehr lesen for Renewable EnergyCarbon neutrality plays an important role in the transition to net-zero. Whilst you work to urgently reduce your emissions, in the interim, you can contribute to sustainable development and nature-based solutions.

Mehr lesen for Carbon NeutralityEcoAct’s Carbon and Energy Pricing Tool can support you through analysis of regulatory risks and implementation of a tailored carbon pricing mechanism. We know the demands of business are many. We can help reduce the burden of this one.

Mehr lesen for Carbon PricingAchieving the ISO 50001 standard enables your business to continually reduce energy use, costs and GHG emissions. EcoAct can help your business meet the ISO 50001 standard, guiding you through each step of the process.

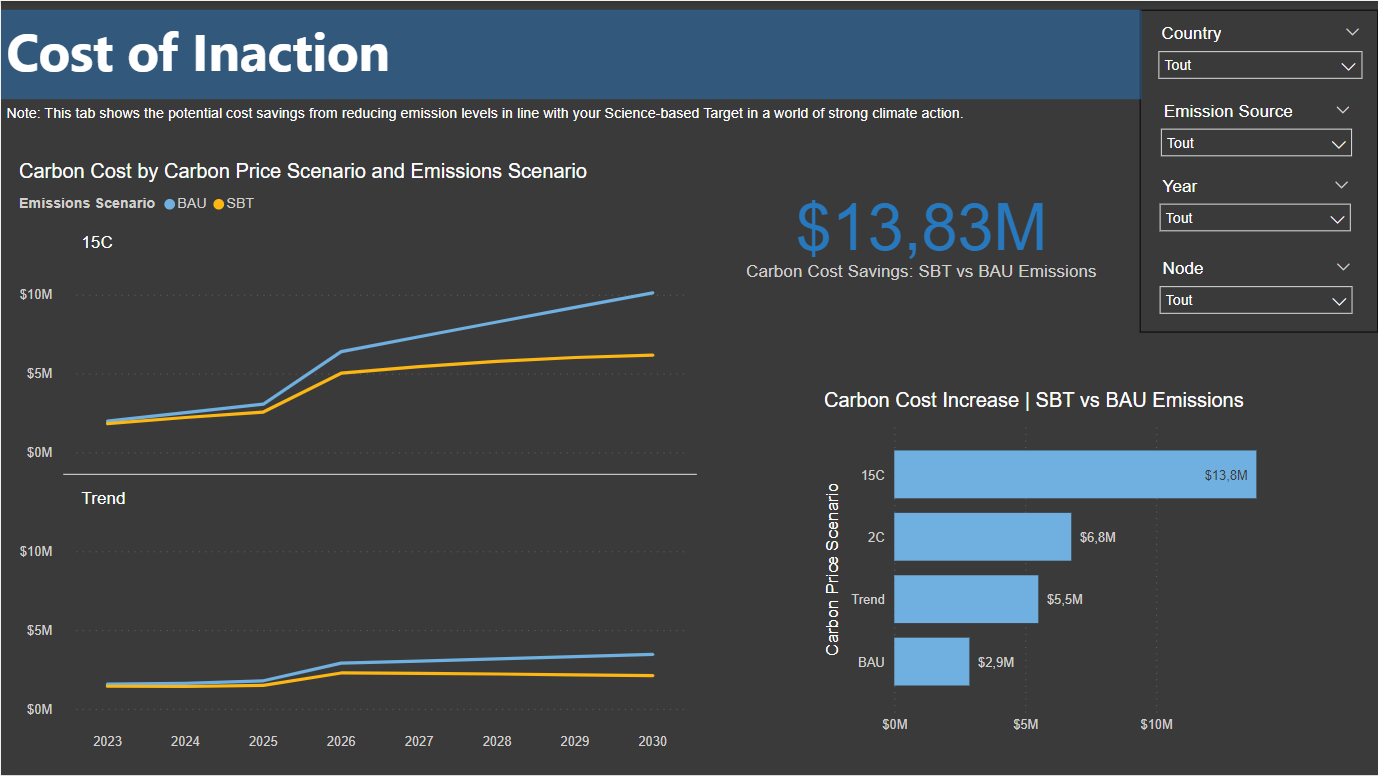

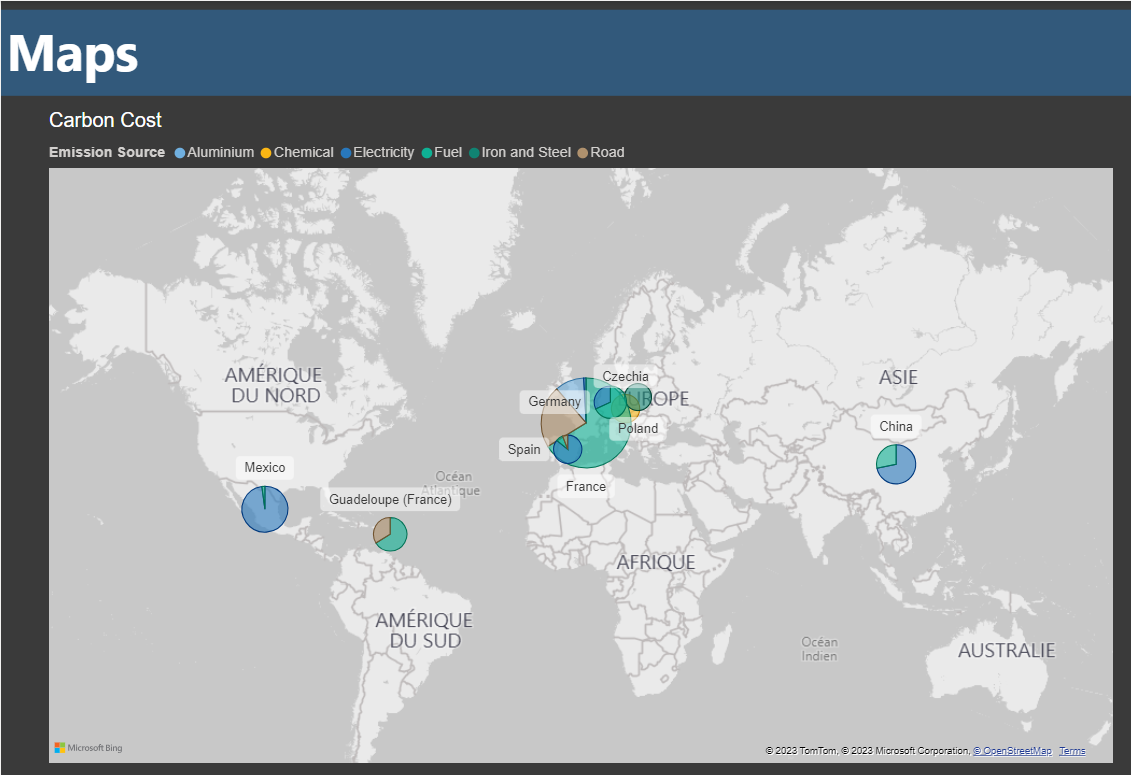

To better understand the positive or negative financial impacts resulting from the implementation of a low-carbon economic model, the Carbon and Energy Pricing Tool will support you to:

Specifically, the Carbon and Energy Pricing Tool allows modelling, at a country and sector level, based on three scenarios of energy and carbon price developments up to 2050:

The tool also enables businesses to integrate their forecasts for the purchase of goods and services and energy consumption. Numerous modular charts and graphs facilitate a quick and visual understanding of key messages. The tool also allows for swift identification of the most exposed service lines and products that require immediate action.

Developed by climate economics experts at EcoAct, the Carbon and Energy Pricing Tool relies on internal regulatory monitoring of carbon taxes and Emission Trading Schemes development and energy price projections from Enerdata, a recognised data provider.

You can also use the Carbon and Energy Pricing Tool to do the following:

Carbon pricing serves as a mechanism that captures the external costs of greenhouse gas (GHG) emissions. These expenses represent the costs the public bears, such as damage to crops or property loss from extreme weather events. Carbon pricing links these costs back to their sources through a price, typically manifesting as a cost associated with emitted carbon dioxide (CO2).

Carbon pricing mechanisms transfer the responsibility for the damages incurred by GHG emissions to the entities accountable for them, while also granting them the choice to take action. Instead of prescribing specific emission reduction measures and locations, carbon pricing provides an economic incentive to emitters. It empowers them to either modify their practices and reduce emissions or continue emitting but paying for their emissions. This flexibility enables us to achieve our environmental objectives in the most adaptable and cost-effective manner for society as a whole.

Establishing an appropriate price for GHG emissions holds paramount importance in internalising the external costs of climate change in a wide array of economic decisions and in creating economic incentives for faster decarbonisation, investment and innovation into a cleaner, sustainable development.

There are two types of carbon pricing mechanisms:

Regulatory Carbon Pricing: Governments require firms in certain industries to pay for their carbon emissions. Usually implemented via a carbon tax or cap-and-trade system.

Internal Carbon Pricing: Companies voluntarily apply a price to carbon emissions within their operations and/or supply chain to drive their decarbonisation efforts.

Access our factsheet to learn what an internal carbon price is, why your organisation should set one and how EcoAct can help with our three-phase approach.

Learn what regulatory carbon pricing is, how it is changing and how businesses will be affected. EcoAct’s carbon pricing tool can help companies measure their exposure to regulatory carbon pricing and the financial implications of potential decarbonisation actions.

Im Rahmen unseres Serviceangebots senden wir Ihnen druckfrische Branchenneuigkeiten, Expertenkommentare und informative Publikationen.

Gesellen Sie sich zu Tausenden von Abonnenten und erhalten Sie die neuesten Einblicke direkt in Ihren Posteingang.